Ch-1 NATURE AND PURPOSE OF BUSINESS

ECONOMIC AND NON-ECONOMIC ACTIVITIES

All Human beings have different types of needs. So, in order to fulfill those needs they have to perform some or the other activity. Human activities are classified into Economic & non-economic activities.

Basic to Meaning | Economic | Non-Econoimic |

Purpose/ Notice | Those activities whose Objective is to earn money and to create wealth. | Those activities whose aim is not to earn money, but to satisfy social, psychological and emotional needs. For example love, sympathy, patriotism. |

Examples | People work in factories | A housewife cooking food for her family. A teacher training his daughter at home. |

Concept of Business: - Business refers to those economic activities involving the purchase production and / or sale of goods and services with a motive of earning profit by satisfying human needs in society.

Characteristics of Business:

1. An economic activity: Business in considered as an economic activity because it is undertaken with the objective of earning money.

2. Production or procurement of goods and services: Business includes all the activities concerned with the production or procurement of goods & services for sales. Services include transportation, banking, Insurance etc. Goods may consist of consumable items.

3. Sale or exchange of goods & services - There should be sale or exchange of goods and service between the seller & the buyer.

4. Dealing in goods & services at a regular basis: There should be regularity of dealings or exchange of goods & services. One single transaction of sale or purchase does not constitute business.

5. Profit Earning: The main purpose of business is to earn profit. A business cannot survive without making profits.

6. Uncertainty of return: Every business invests money with the objective of earning profit but the amount of profit earned may vary. Also there is always a possibility of losses.

7. Element of risk: All business activities carry some elements of risk because future is uncertain and business has no control over several factors like, strikes, fire, theft, and change in consumer taste etc.

Business: Refers to Purchase, production and/ or sale of goods & services with the objective of earning profit.

Profession: Includes those activities which require special knowledge & skills in the occupation.

Employment: Refers to the occupation in which people work for others and get remuneration in return.

Basis of Destruction | Business | Profession | Employment |

Mode of establishment | Starts after completing some legal formalities if needed. | Membership of a professional body and certificate of practice required. | Start after getting appointment letter. |

Nature of work | Provision of goods and service to the public. | Personalized services of expert nature. | Work allotted by the employer according to the contract. |

Qualification | No minimum qualification is necessary. | Professional Qualification and training required. | Qualification and training as prescribed by the employer. |

Capital investment | Capital needed according to its size and capacity. | Limited capital for established | No capital required. |

Reward/ Returns | Profits | Professional fee | Salary or wages |

Risk | High Risk | Low Risk | No Risk |

Code of Conduct | No code of conduct | Professional code of conduct | The terms and conditions of services contract are to be allowed. |

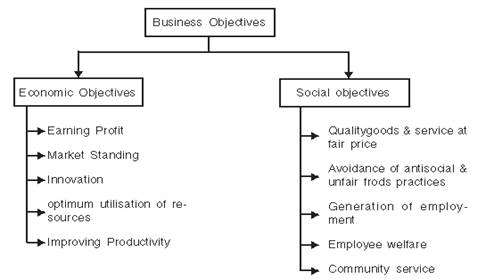

Objectives of Business: The objective of business means the purpose for which a business is established and carried on. Proper selection of objectives is essential for the success of a business.

The businessmen always have multiple objectives. All objective may be classified into two broad categories. These are (1) Economic objectives and (2) Social Objectives

1. Economic Objectives

Business is an economic activity and therefore, its purpose is to show economic results. The economic objectives of business are follows:

(i)Earning profit: Profit means excess of income over the expenditure. The foremost and prime objective of every businessman is to earn profit. A business cannot service without earning profit. Not only for survival but it is also required for growth and expansion of business.

(ii)Market standing/creation of customer: Business can survive for a longer period only if is able to capture a big share in the market & has market standing. It is possible only when business provides goods and services to satisfy the needs & wants of customers. Therefore, creation and satisfaction of customers (market) is an important objective of business.

(iii)Innovations: Innovation means making new products or adding new features of old products for making it more useful, improving methods of production & distribution exploring new markets, etc. In these days of competition, a business can be successful only when it creates new designs, better machines, improved techniques, new varieties etc.

(iv)Optimum utilization of resources: It refers to the best use of men, material, money and machinery employed in business. The resources of business are scarce so these must be utilized in the best possible manner so that the business can get maximum benefit from their resources.

(v)Improving productivity: It is used as a measure of efficiency. Every business enterprise must aim at greater productivity - to ensure continuous survival and growth. This objective can be achieved by reducing wastages and making efficient use of machines and equipments, human resources, money etc.

2.Social Objectives

Business is an integral part of society. It makes use of resources of society. It earns profit by selling its products or services to members of society. So it becomes obligatory on the part of the businessman to do something for the society. The important social objectives of business are as follows:

(i)Quality goods and services at Fair Price: The first social objective of business is to provide better quality product at reasonable rice and in proper quantity on continuous basis to consumers examples.

Example: Consumers look for ISI mark on electrical goods, FPO mark on food products. Hallmark on Jewellery.

(i) Avoidance of Anti-Social and Unfair trade practices: Anti-Social practices include hoarding, black marketing and adulteration. Making false claims in advertisements to mislead and exploit people is an example of unfair trade practice. Business should not indulge in such practices.

(ii) Generation of Employment: Now days, employment is the biggest problem of society. Business should provide employment to more and more people living in the country. Handicapped and disabled people should be given extra care.

(iii) Employee Welfare: Employees are a valuable asset and they make significant contributions towards the success of business. Another social objective of business, therefore, is to ensure welfare of employees by providing good working conditions, fair wages and facilities such as housing, medical and entertainment etc. such welfare facilities help to improve physical and mental health of employees.

(iv) Community service: Business should contribute something to the society where it is established and operated Library, dispensary, educational institutions etc. are certain contributions which a business can make and help in the development of community.

Role of Profit in Business

Business is established for the purpose of earning profit. Profit plays a very important role in business. The role of profit in business can be brought out by the following facts :-

(1) For Long Survival: Profit alone help a business to continue to exist for a long period. In the absence of profit the establishment of a particular business loses its justification.

(2) For growth & Expansion: All businessmen want their business to expand and to grow. For development of business additional capital is needed. Retained earnings is a very good source of capital.

(3) For increasing efficiency: Profit is that power which motivates both the parties - owner and workers to do their best. As they know that in case of good profits they will get good compensation for their efforts so it finally helps in increasing the efficiency of business.

(4) For Building prestige and Recognition: For gaining prestige in the Society, Business had to satisfy all the parties concerned. It has to supply good quality product/service at reasonable price to customers, adequate remuneration to employees, to pay sufficient dividend to the shareholdersetc. and all these are possible only if the business is earning good profit.

Primary Industry: The primary industry includes those activities through which the natural resources are used to provide raw material for other industries Primary industries are of two types.

Extractive Industry refers to those industries under which something is extracted out of the earth, water or air e.g., coal, iron, gas etc. Farming, mining, lumbering, hunting & fishing come under this category of industry

Genetic Industry refers to those industries under which the breed of animals and vegetables are improved and made more useful e.g., poultry farms, dairy farming, fish hatchery, cattle breeding etc.

Secondary Industry: Under this industry new products are manufactured by using the previously produced things e.g., producing cotton is a primary industry and manufacturing cloth out of cotton is a secondary industry. It is of two types.

Manufacturing: These industries convert raw materials or semi-finished products into finished products e.g., paper from bamboo, sugar from sugar cane. It is further divided into four parts.

(i) Analytic: Different things are manufactured out of one material e.g., petrol, diesel, gasoline out of crude oil.

(ii) Processing: Those industries wherein useful things are manufactured by making the raw material to pass through different production process e.g., steel from iron ore, sugar and paper industries.

(iii) Synthetic: Many raw materials are mixed to produce more useful product e.g., paints, cosmetics, cement.

(iv) Assembling: Where in the parts manufactured by different industries are assembled to produce new and useful product e.g., computers, watches cars, television etc.

2.Construction industries: Industries that are involved in the construction of buildings, dams, bridges, roads as well as tunnels and canals.

3 Tertiary or Service Industry: Includes those services which help business to move smoothly e.g. transport, bank, Insurance, storage and Advertising.

COMMERCE:

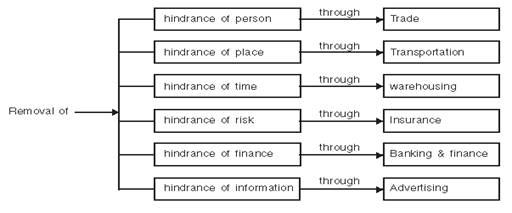

Meaning: Commerce refers to all those activities which are concerned with the transfer of goods and services from the producers to the consumers. It embraces all those activities which are necessary for maintaining a free flow of goods and services.

The functions of commerce are as follows.

1. Removing the hindrance of person by marking goods available to consumers from the producers. through trade.

2. Transportation removes hindrance of place by moving goods from the place of production to the markets for sale.

3. Storage and warehousing activities remove the hindrance of time by facilitating holding of stock of goods to be sold as and when required.

4. Insurance removes hindrance of risk of loss or damage of goods due to theft, fire, accidents etc.

5. Banking removes hindrance of finance-by providing funds to a businessman for acquiring assets, purchasing raw materials and meeting other expenses.

6. Advertising removes hindrance of information-by informing consumers about the goods and services available in the market.

Commerce includes two types of activities:

Trade: Refers to buying and selling of goods and services with the objective of earning profit. It is classified into two categories:

1. Internal Trade: Takes place within a country. Internal Trade is classified into two categories:

(i) Wholesale Trade: Refers to buying and selling of goods in large quantities. A wholesaler buys goods in large quantities from the producers and sell them to other dealers. He serves as a connecting link between the producer and retailer.

(ii) Retail Trade: Refers to buying of goods and services in relatively small quantities & selling them to the ultimate consumers.

2. External Trade: Trade between two or more countries. External trade can be classified into three categories:

(i) Import trade: If goods are purchased from another country, if is called import trade.

(ii) Export Trade: If goods are sold to other countries it is called export trade.

(iii) Enterpot: Where goods are imported for export to other countries e.g. Indian firms may import some goods from America and export the service to Nepal.

Auxiliaries to Trade: All those activities which help in removing various hindrances which arise in connection with the production and distribution of goods are called auxiliaries to trade. An overview of these activities is given below.

(i) Transportation and Communication: The production of goods takes place at one place where as these are demanded in different parts of the country The obstacle of place is removed by the transport. Along with transport communication is also an important service. It helps in exchange of information between producers, consumers and traders. The common communication services are postal service, telephone, fax, internet etc.

(ii) Banking and Finance: Business needs funds for acquiring assets, purchasing raw materials and meeting other expenses. Necessary funds can be obtained from a bank.

(iii) Insurance: It provides a cover against the loss of goods, in the process of transit, storage, theft, fire and other natural calamities.

(iv) Warehousing: There is generally a time lag between the production and consumption of goods. This problem can be solved by storing the goods in warehouses from the time of production till the time they are demanded by customers.

(vi)Advertising: Advertising brings goods and services to the knowledge of prospective buyers. It is through advertising that the customers come to know about the new products and their utility.

(you will learn this thing in detail in upcoming units)

Business Risk: Business risk refers to the possibility of inadequate profits or even losses due touncertainities or unexpected events. For example: demand for a particular product may decline due to change in tastes preferences of consumers, or increase in competition etc. There are two types of business risks:

Nature of Business Risks

1. Business risks arise due to uncertainties: Lack of knowledge of what is going to happen in future create uncertainties in business. It may be due to natural calamities, change in demand and prices, strikes etc.

2. Risk is an essential part of every business: No business can avoid risk although the amount of risk may vary from business to business. Risk can be minimized but cannot be eliminated.

3. Degree of risk depends mainly upon the nature and size of business: Level of risk is lower for small scale business while it is higher for large scale organization.

4.Profit is the reward for risk taking: A business gets profit as return for undertaking risk. Greater the risk involved in a business, higher is the chance of profit.

Causes of Business Risks

1. Natural Causes: Human beings have little control over natural calamities like flood, earthquake, famine etc. They result in heavy losses of life, property & income in business.

2. Human Causes: Human causes include such unexpected events like dishonesty, carelessness or negligence of employees, strikes, riots, management inefficiency etc.

3. Economic causes: They are related to a chance of loss due to change in market condition e.g., fluctuations in demand and prices, competition, change in technology etc.

4. Physical causes: Mechanical defects or failures may also lead to losses e.g., bursting of boiler or machine may cause death or destruction.

5. Other causes: These include unforeseen events like political disturbances, fluctuation in exchange rates etc

Starting a Business: Basic Factors

Selecting the line of business: The first thing to be decided by the entrepreneur is the line and type of business to be undertaken.

1. Scale or size of business: After deciding the line of business the businessman must decide whether he wants to set up large scale or small scale business.

2. Choice of form of Business organization: The next decision must be taken is to finalize the form of business i.e., to set up sole proprietorship., partnership or joint stock company.

3. Location of Business Enterprise: The entrepreneur has to decide the place where the enterprise will be located. Before taking this decision he must find out availability of raw materials, power, labour, banking, transportation etc.

4. Financial Requirement: The businessman must analyze the amount of capital he might require to buy fixed assets and for working capital (Day to day expenses) Proper financial planning must be done to determine the amount of funds needed.

5. Physical facilities: include machinery equipment building etc. This decision depends upon the size, scale and type of business activities he wants to carry on.

6. Plant layout: Showing the physical arrangement of machines and equipment needed to manufacture a product.

7. Competent and committed Workforce: The entrepreneur must find out the requirement of skilled and unskilled workers and managerial staff to perform various activities.

8. Tax planning: The entrepreneur must try to analyze the types of taxes because there are a number of tax laws in the country which affect the functioning of business.

9. Setting up of the Enterprise: After analyzing the above mentioned points carefully the entrepreneur can start the business which would mean mobilizing various resources and completing legal formalities.

--- End-----

Ch-2 FORMS OF BUSINESS ORGANISATION

Meaning

A business enterprise is an institutional arrangement to form any business activity.

Classification

On the basis of ownership business enterprises can broadly be classified into the following categories:

In case of CORPORATE FORM of private enterprises the identity of the enterprise is separate from that of the owner and in case of NON CORPORATE FORM, the identity of the enterprise is not different from that of its owners.

Sole Proprietorship

Sole proprietorship means a business owned, financed and controlled by a single person who is recipient of all profit and bearer of all risks.

It is SUITABLE IN AREAS OF PERSONALISED SERVICE like beauty parlour, hair cutting saloons & small scale activities like retail shops.

Features/ characteristics

1. Single ownership: It is wholly owned by one individual.

2. Control: Sole proprietor has full power of decision making.

3. No separate legal entity: Legally there is no difference between business& businessmen.

4. Unlimited liability: The liability of owner is unlimited. In case the assets of business are not sufficient to meet its debts, the personal property of owner can be used for paying debts

5. No legal formalities: Not required to start, manage and dissolve such business organization.

6. Sole risk bearer and profit recipient: He bears the complete risk and there is no body to share profit/loss with him.

Merits/Advantage/Pros

1. Easy to start and close: It can be easily started and closed without any legal formalities.

2. Quick decision making: As sole trader is not required to consult or inform anybody about his decisions.

3. Sense of accomplishment: There is a sense of personal satisfaction.

4. Unlimited liability: The liability of owner is unlimited. In case the assets of business are not sufficient to meet its debts, the personal property of owner can be used for paying debts

5. No legal formalities: are required to start, manage and dissolve such business organization.

6. Sole risk bearer and profit recipient: He bears the complete risk and there is no body to share profit/loss with him.

LIMITATIONS/Demerits/ Cons

1. Limited financial resources: Funds are limited to the owner's personal savings and his borrowing capacity.

2. Limited Managerial ability: Sole trader can’t be good in all aspects of business and he can’t afford to employ experts also.

3. Unlimited liability: Ofcourse, sole trader compels him to avoid risky and bold business decisions.

4. Uncertain life: Death, insolvency, lunacy or illness of a proprietor affects the business and can lead to its closure.

5. Limited scope for expansion:- Due to limited capital and managerial skills, it cannot expand to a large scale.

SUITABILITY:

Sole tradership is suitable-

• Where the personal attention to customer is required as in tailoring, beauty parlour.

• Where goods are unstandardized like artistic jewellery.

• Where modest capital and limited managerial skills are required as in case of retail store

• Business where risk is not extensive i.e. lesser fluctuation in price and demand i.e. stationery shop.

JOINT HINDU FAMILY BUSINESS

It is owned by the members of undivided joint Hindu family and managed by the eldest member of the family known as KARTA. It is governed by the provisions of Hindu law. The basis of membership is birth in a particular family.

FEATURES

1. Formation - For a joint Hindu family business there should be at least two members in the family and some ancestral property to be inherited by them.

2. Membership by birth -

There are two systems which govern membership

Dayabhaga System- It prevails in west Bengal and allows both male and female member to co-parcencers.

Mitakshara System- It prevails all over India except West Bengal and allows only male members to be coparceners.

3. Liability - Liability of Karta is unlimited but of all other members is limited to the extent of their share in property

4. Continuity - The business is not affected by death or incapacity of Karta in such cases the next senior male member becomes the Karta.

5. Minor members - A minor can also become full fledged member of Family business.

MERITS

1. Effective control- The Karta can promptly take decisions as he has the absolute decision making power.

2. Continued business existence- The death, Lunacy of Karta will not affect the business as next eldest member will then take up the position.

3. Limited liability - The liability of all members except Karta is limited. It gives them a relief.

4. Secrecy - Complete secrecy regarding business decisions can be maintained by Karta.

5. Loyalty and Co-operation: It helps in securing better co-operation and greater loyalty from all the members who run the business.

LIMITATION

1. Limited capital: There is shortage of capital as it is limited to the ancestral property.

2. Unlimited liability of karta - It makes him less enterprising.

3. Dominance of karta - Karta manages the business and sometimes he ignores the valuable advice of other members. This may cause conflict among the members and may lead to break down of the family limit.

4. Hasty decisions: As karta is overburdened with work, he may take hasty and unbalanced decisions.

5. Limited managerial skills of karta also pose a serious problem. The Joint Hindu family business is on decline because of the diminishing no. of joint Hindu families in the country.

PARTNERSHIP

Meaning: Partnership is a voluntary association of two or more persons who agree to carry on some business jointly and share its profits and losses.

FEATURES

1. Two or more persons: There must be at least two persons to form a partnership. The maximum no. of persons is 10 in banking business and 20 in non-banking business.

2. Agreement: It is an outcome of an agreement among partners which may be oral or in writing.

3. Lawful business- It can be formed only for the purpose of carrying on some lawful business.

4. Decision making & control - Every partner has a right to participate in management & decision making of the organisations.

5. Unlimited liability - Partners have unlimited liability.

6. Mutual Agency - Every partner is an implied agent of the other partners and of the firm. Every partner is liable for acts performed by other partners on behalf of the firm.

7. Lack of continuity - Firms existence is affected by the death, Lunacy and insolvency of any of its partner. It suffers from lack of continuity.

MERITS

1. Ease of formation & closure - It can be easily formed. Only an agreement among the partners is required.

2. Larger financial resources - There are more funds as capital is contributed by no. of partners.

3. Balanced Decisions - As decisions are taken jointly by partners after consulting each other.

4. Sharing of Risks - In it, risk get distributed among partners which reduces anxiety, burden and stress on individual partner.

5. Secrecy - Secrecy can be easily maintained about business affairs as they are not required to publish their accounts or to file any report to the govt.

LIMITATIONS

1. Limited resources - There is a restriction on the number of partners and hence capital contributed by them is also limited.

2. Unlimited liability- The liability of partners is unlimited and they are liable individually as well as jointly. It may prove to be a big drawback for those partners who have greater personal wealth. They will have to repay the entire debt in case the other partners are unable to do so.

3. Lack of continuity - Partnership comes to an end with the death, retirement, insolvency or lunacy of any of its partner.

4. Lack of public confidence - Partnership firms are not required to publish their reports and accounts. Thus they lack public confidence.

TYPES OF PARTNERS

1. General / Active Partner - Such a partner takes active part in the management of the firm.

2. Sleeping or Dormant Partner - He does not take active part in the management of the firm. Though he invested money, shares profit & Loss and unlimited liability.

3. Secret Partner - He participates in business secretly without disclosing his association with the firm to general public. His liability is also unlimited.

4. Nominal Partner - Such a partner only gives his name and goodwill to the firm. He neither invests money nor takes profit. But his liability is unlimited.

5. Partner by Estoppels - He is the one who by his words or conduct gives impression to the outside world that he is a partners of the firm whereas actually he is not. His liability is unlimited towards the third party who has entered into dealing with firm on the basis of his pretensions.

6. Partner by holding out - He is the one who is falsely declared partner of the firm whereas actually he is not. And even after becoming aware of it, he-does not deny it. His liability is unlimited towards the party who has deal with firm on the basis of this declaration.

Minor as a Partner

A minor is a person who has not attained the age of 18 years. Since a minor is not capable of enlarging into a valid agreement. He cannot become partner of firm. However, a minor can be admitted to the benefits of an existing partnership firm with the mutual consent of all other partners. He cannot be asked to bear the losses. His liability will be limited to the exilent of the capital contributed by him. He will not be eligible to take an active part in the management of the firm.

Types of Partnership

A. Classification on the Basics of Duration

Partnership at will- This type of partnership exists at the will of partners.

Particular Partnership-This type of partnership is formed for a specified June period to accomplish a particular project (consolation of building)

B. Classification on the basis of Liability

General partnership-This liability of partners is limited and joint. Registration of firm is optional.

Limited Partnership-The liability of at least one partner is unlimited whereas the other partners may have limited.

Registration of firm is compulsory.

PARTNERSHIP DEED

The written agreement on a stamped paper which specifies the terms and conditions of partnership is called the partnership deed.

It generally includes the following aspects –

• Name of the firm

• Location / Address of the firm

• Duration of business.

• Investment made by each partner.

• Profit sharing ratio of the partners

• Terms relating to salaries, drawing, interest on capital and interest on drawing of partners.

• Duties & obligations of partners.

• Terms governing admission, retirement & expulsion of a partner, preparation on of accounts & their auditing.

• Method of solving dispute

REGISTRATION OF PARTNERSHIP

Registration is not compulsory it is optional. But it is always beneficial to get the firm registered. The consequences of non-registration of a firm are as follows:

• A partner of an unregistered firm cannot file suit against the firm or the partner.

• The firm cannot file a suit against third party.

• The firm cannot file a case against its partner.

Co-operative Society

A co-operative society is a voluntary association of persons of moderate means who unite together to protect & promote their common economic interests.

FEATURES

1. Voluntary association: Every one having a common interest is free to join a co-operative society and can also leave the society after giving proper notice.

2. Legal status: Its registration is compulsory and it gives it a separate legal identity.

3. Limited liability: The liability of the member is limited to the extent of their capital contribution in the society.

4. Democratic control: Management & Control lies with the managing committee elected by the members by giving vote. Every member has one vote irrespective of the number of shares held by him.

5. Service motive: The main aim is to serve its members and not to maximize the profit.

6. Bound by govt.’s rules: They have to be tide by the rules and regulations framed by govt. for them.

7. Distribution of surplus: The profit is distributed on the basis of volume of business transacted by a member and not on the basis of capital contribution of members.

MERITS

1. Excise of formation: It can be started with minimum of 10 members. Registration is also easy as it requires very few legal formations.

2. Limited Liability: The liability of members is limited to the extent of their capital contribution.

3. Stable existence: Due to registration it is a separate legal entity and is not affected by the death, luxury or insolvency of any of its member.

4. Economy in operations: Due to elimination of middlemen and voluntary services provided by its members.

5. Government Support: Govt. provides support by giving loans at lower interest rates, subsidies & by charging less taxes.

6. Social utility: It promotes personal liberty, social justice and mutual cooperation. They help to prevent concentration of economic power in few hands.

LIMITATIONS

1. Shortage of capital - It suffers from shortage of capital as it is usually formed by people with limited means.

2. Inefficient management - Co-operative society is managed by elected members who may not be competent and experienced. Moreover, it can’t afford to employ expert and experienced people at high salaries.

3. Lack of motivation - Members are not inclined to put their best efforts as there is no direct link between efforts and reward.

4. Lack of Secrecy - Its affairs are openly discussed in its meeting which makes it difficult to maintain secrecy.

5. Excessive govt. control - it suffers from excessive rules and regulations of the govt. It has to get its accounts audited by the auditor and has to submit a copy of its accounts to registrar.

6. Conflict among members - The members are from different sections of society with different viewpoints. Sometimes when some members become rigid, the result is conflict.

TYPES OF CO-OPERATIVE SOCIETIES

1. Consumers co-operative Society - It formed to protect the interest of consumers.It seeks to eliminate middleman by establishing a direct link with the producers. It purchases goods of daily consumption directly from manufacturer or wholesalers and sells them to the members at reasonable prices.

2. Producer's Co-operative Society - The main aim is to help small producers who cannot easily collect various items of production and face some problem in marketing. These societies purchase raw materials, tools, equipments and other items in large quantity and provide these things to their members at reasonable price.

3. Marketing Co-operative Society - It performs various marketing function such as transportation, warehousing, packing, grading, marketing research etc. for the benefit of its members. The production of different members is pooled together and sold by society at good price.

4. Farmer’s Co-operative Society - In such societies, small farmers join together and pool their resources for cultivating their land collectively. Such societies provide better quality seeds, fertilizers, machinery and other modern techniques for use in the cultivation of crops. It provides them opportunity of cultivation on large scale.

5. Credit co-operative Society - Such societies protect the members from exploitation by money lenders. They provide loans to their members at easy terms and reasonably low rate of interest.

6. Co-operative Housing Society - The main aim is to provide houses to people with limited means/income at reasonable price.

JOINT STOCK COMPANY

Meaning - Joint stock company is a voluntary association of persons for profit, having a capital divided into transferable shares, the ownership of which is the condition of membership.

FEATURES

1. Incorporated association - The company must be incorporated or registered tender the companies Act 1956. Without registration no company can come into existence.

2. Separate Legal Existence - It is created by law and it is a distinct legal entity independent of its members. It can own property, enter into contracts, can file suits in its own name.

3. Perpetual Existence - Death, insolvency and insanity or change of members as no effect on the life of a company. It can come to an end only through the prescribed legal procedure.

4. Limited Liability - The liability of every member is limited to the nominal value of the shares bought by him or to the amt. guaranteed by him. Transferability of shares - Shares of public Co. are easily transferable. But there are certain restrictions on transfer of share of private Co. Common Seal- It is the official signature of the company and it is affixed on all important documents of company.

5. Separation of ownership and control - Management of company is in the hands of elected representatives of shareholders known individually as director and collectively as board of directors.

MERITS

1. Limited Liability - Limited liability of shareholder reduces the degree of risk borne by him.

2. Transfer of Interest - Easy transferability of shares increases the attractiveness of shares or investment.

3. Perpetual Existence - Existence of a company is not affected by the death, insanity,

Insolvency of member or change of membership. Company can be liquidated only as per the provisions of companies Act.

4. Scope for expansion - A company can collect huge amount of capital from unlimited no. of members who are ready to invest because of limited liability, easy transferability and chances of high return.

5. Professional management - A company can afford to employ highly qualified experts in different areas of business management.

LIMITATIONS

1. Legal formalities - The procedure of formation of Co. is very long, time consuming, expensive and requires lot of legal formalities to be fulfilled.

2. Lack of secrecy - It is very difficult to maintain secrecy in case of public company, as company is required to publish and file its annual accounts and reports.

3. Lack of Motivation - Divorce between ownership and control and absence of a direct link between efforts and reward lead to lack of personal interest and incentive.

4. Delay in decision making - Red papism and bureaucracy do not permit quick decisions and prompt actions. There is little scope for personal initiative.

5. Oligarchic management - Co. is said to be democratically managed but actually managed by few people i.e. board of directors. Sometimes they take decisions keeping in mind their personal interests and benefit, ignoring the interests of shareholders and Co.

TYPES OF COMPANIES

On the basis of ownership, companies can be divided into two categories –

Private & Public.

* Difference between Private Company & Public Co.(Imp)

FORMATION OF A COMPANY

Formation of a company means bringing a company into existence and starting its business. The steps involved in the formation of a company are:

(i) Promotion

(ii) Incorporation

(iii)Capital subscription

(iv) Commencement of business.

A private company has to undergo only first two steps but a public company has to undergo all the four stages.

1. Promotion:

Promotion means conceiving a business opportunity and taking an initiative to form a company.

Step in Promotion:

1. Identification of Business Opportunity : The first and foremost function of a promoter is to identify a business idea e.g. production of new product or service.

2. Feasibility Studies: After identifying a business opportunity the promoters undertake detailed studies of technical, Financial, Economic feasibility of a business.

3. Name Approval: After selecting the name of company the promotors submit an application to the Registrar of companies for its approval.

4. Fixing up signatories to the Memorandum of Association: Promotors have to decide about the director who will be signing the memorandum of Association.

5. Appointment of professional: Promoters appoint merchant bankers, auditors etc.

6. Preparation of necessary documents: The promoters prepare certain legal documents such as memorandum of Association, Articles of Association which have to be submitted to the Registrar of the companies.

2. Incorporation

Incorporation means registration of the company as body corporate under the companies Act 1956 and receiving certificate of Incorporation.

Steps for Incorporation

1. Application for incorporation: Promoters make an application for the incorporation of the company to the Registrar of companies.

2. Filing of necessary documents: Promoters files the following documents:

(i) Memorandum of Association.

(ii) Articles of Association.

(iii) Statement of Authorized Capital

(iv) Consent of proposed director.

(v) Agreement with proposed managing director.

(vi) Statutory declaration.

3. Payment of fees: Along with filing of above documents, registration fee has to be deposited which depends on amount of the authorized capital.

4. Registration: The Registrar verifies all the document submitted. If he is satisfied then he enters the name of the company in his Register.

5. Certificate of Incorporation: After entering the name of the company in the register. The Registrar issues a Certificate of Incorporation. This is called the birth certificate of the company.

III. Capital Subscription:

A public company can raise funds from the public by issuing shares and Debentures. For this it has to issue prospectus and undergo various other formalities:

Step required for raising funds from public:

1. SEBI Approval: SEBI regulates the capital market of India. A public company is required to take approval from SEBI.

2. Filing of Prospectus: Prospectus means any documents which invites offers from the public to purchase share and Debenture of the company.

3. Appointment of bankers, brokers, underwriters: Banker of the company receive the application money. Brokers encourage the public to apply for the shares, underwriters are the person who undertake to buy the shares if these are not subscribed by the public. They receive a commission for underwriting.

4. Minimum subscription: According to the SEBI guide lines minimum subscription is 90% of the issue amount. If minimum subscription is not received then the allotment cannot be made and the application money must be returned to the applicants within 30 days.

5. Application to Stock Exchange: It is necessary for a public company to list their shares in the stock exchange therefore the promoters apply in stock exchange to list company shares.

6. Allotment of Shares: Allotment of shares means acceptance of share applied. Allotment letters are issued to the shareholders. The name and address of the shareholders submitted to the Registrar.

IV. COMMENCEMENT OF BUSINESS:

To commence business a public company has to obtain a certificate of commencement of Business. For this the following documents have to be filled with the registrar of companies.

1. A declaration that 90% of the issued amount has been subscribed.

2. A declaration that all directors have paid in cash in respect of allotment of shares made to them.

3. A statutory declaration that the above requirements have been completed and must be signed by the director of company.

Important documents used in the formation of company:

1. Memorandum of Association - It is the principal document of a company. No company can be registered without a memorandum of association and that is why it is sometimes called a life giving document.

Contents of Memorandum of Association:

1. Name clauses - This clause contains the name of the company. The proposed name should not be identicator similar to the name of another exiting company.

2. Situation clauses - This clause contains the name of the state in which the registered office of the company is to be situated.

3. Object clause - This clause defines the objective with which the company is formed. A company is not legally entitled to do any business other than that specified in the object clause.

4. Liability Clauses - This clause limits the liability of the members to the amount unpaid on the shares held by them.

5. Capital clause - This clause specifies the maximum capital which the company will be authorized to raise tough the issue of shares called authorized capital.

2. Articles of Association:

The articles of Association are the rules for the internal management of the affairs of a company the articles defines the duties, rights and powers of the officers and the board of directors.

Contents of the Article:

1. The amount of share capital and different classes of shares.

2. Rights of each class of shareholders.

3. Procedure for making allotment of shares.

4. Procedure for issuing share certificates.

5. Procedure for forfeiture and reissue of forfeited shares.

6. Rules regarding casting of votes and proxy voting

7. Procedure for selection and removal of directors

8. Dividend declaration and payment related rules

9. Procedure for capital readjustment

10. Procedure regarding winding up of the company.

2. Prospectus:

Prospectus means any document which invites deposits from the public to purchase share or debentures of a company.

Main contents of the Prospectus:

1. Company’s name and the address of its registered office.

2. The main object of the company

3. The number and classes of shares.

4. Qualification shares of the directors

5. The name and addresses of the directors, managing director or manager.

6. The minimum subscription which is 90% of the size of the issue.

7. The time of opening and closing of the subscription list.

8. The amt. payable on the application and allotment of each class of share.

9. Underwriters to the issue.

10. Merchant bankers to the issue.

2. Statement is Lieu of Prospectus:

A public company having a share capital may sometimes decide not to raise funds from the public because it may be confident of obtaining the required capital privately. In such case it will have to tile a statement in lieu of prospectus with the Registrar of companies. It Contains information much similar to that of a prospectus.

CHOICE OF FORM OF BUSINESS ORGANISATION

The following factors are important for taking decision about form of organization:

1. Cost and ease in setting up the organization: Sole proprietorship is least expensive and can be formed without any legal formalities to be fulfilled. Company is also expensive with lot of legal formalities.

2. Capital consideration: Business requiring less amount of finance prefer sole proprietorship & partnership form, where as business activities requiring huge financial resonances prefer company form.

3. Nature of business: If the work requires personal attention such as tailoring unit, cutting saloon, it is generally setup as a sole proprietorship. Unit engaged in large scale manufacturing are more likely to be organized in company form.

4. Degree of control desired: A person who desires full and exclusive control over business prefers proprietorship rather than partnership or company because control has to be shared in these cases.

5. Liability or Degree of Risk: Projects which are not very risky can be organized in the form of sole proprietorship partnership whereas the risky ventures should be done in company form of organization because the liability of shareholders is limited.

-End-

CHAPTER : 3

PRIVATE, PUBLIC AND GLOBAL ENTERPRISES

PRIVATE SECTOR ENTERPRISES

The private sector consists of business owned by individuals or a group of individuals. The varios forms of organisation are- sole proprietorship, partnership, joint hindu family, cooperative and company.

PUBLIC SECTOR ENTERPRISES

Meaning: The public sector consists of various organizations owned and managed by central or State or by both governments. The govt. participates in economic activity of the country through these enterprises.

FEATURES:

1. Capital is contributed by central or state or both govts.

2. Public welfare or Service is the main objective.

3. Management & control are in the hands of govt.

4. It is accountable to the public.

I. DEPARTMENT UNDERTAKING

These are established as departments of the ministry and are financed, managed and controlled by either central govt. or state govt.

Examples: Indian Railways, Post & Telegraph departments.

FEATURES

1. No Separate Entity: It has no Separate legal entity.

2. Finance: It is financed by annual budget allocation of the govt. and all its earnings go to govt. treasury.

3. Accounting &Audit: The govt. rules relating to audit & accounting are applicable to it.

4. Staffing: Its employees are govt. employees & are recruited & appointed as per govt. rules.

5. Accountability: These are accountable to the concerned ministry.

MERITS

1. It is more effective in achieving the objective laid down by govt. as it is under the direct control of govt.

2. It is a source of govt. income as its revenue goes to govt. treasury.

3. It is accountable to parliament for all its actions which ensures proper utilization of funds.

4. It is suitable for activities where secrecy and strict control is required like defence production.

DEMERITS

1. It suffers from interference from minister and top officials in their working.

2. It lacks flexibility which is essential for smooth operation of business.

3. It suffers from red tapism in day to day Work.

4. These organizations are usually insensitive to consumer needs and do not provide goods and adequate service to them.

5. Such organization are managed by civil servants and govt. officials who may not have the necessary expertise and experience in management.

SUITABILITY:

(i) Where full Govt. control is needed.

(ii) where secrecy is very important such as defence.

STATUTORY CORPORATIONS

It is established under a special Act passed in parliament or state legislative assembly. Its objectives, powers and functions are clearly defined in the special Act.

Examples: Unit Trust of India, Life Insurance Corporation.

FEATURES

1. It is established under a special act which defines its objects, powers and functions.

2. It has a separate legal entity.

3. Its management is vested in a Board of directors appointed or nominated by government.

4. It has its own staff, recruited and appointed as per the provisions of act.

5. This type of enterprise is usually independently financed. It obtains funds by borrowing from govt. or from public or through earnings.

6. It is not subject to same accounting & audit rules which are applicable to govt. department.

MERITS

1. Internal Autonomy: It enjoys a good deal of autonomy in its day to day operations and is free from political interference.

2. Quick decisions: It can take prompt decisions and quick actions as it is tree from the prohibitory rules of govt.

3. Parliamentary control: Their performance is subject to discussion in parliament which ensures proper use of public money.

4. Efficient Management: Their directors and top executives are professionals and experts of different fields.

DEMERITS

1. In reality, there is not much operational flexibility. It suffers from lot of political interference.

2. Usually they enjoy monopoly in their field and do not have profit motive due to which their working turns out to be inefficient.

3. Where there is dealing with public, rampant corruption exists. Thus public corporation is suitable for undertaking requiring monopoly powers e.g. public utilities.

SUITABILITY: It is suitable for organizing public enterprise when,

(i) The enterprise requires special power under an Act.

(ii) The enterprise requires a huge amount of capital investment.

GOVERNMENT COMPANY

A government company is a company in which not less than 51% of the paid up share capital is held by the central govt. or state govt. or jointly by both.

Examples: Hindustan Insecticides Ltd., State Trading Corp. of India, Hindustan Cables Ltd.

FEATURE

1. It is registered or Incorporated under companies Act1956.

2. It has a separate legal entity.

3. Management is regulated by the provision of companies Act.

4. Employees are recruited and appointed as per the rules and regulations contained in Memorandum and Articles of association.

5. The govt. Co. obtains it funds from govt. shareholdings and other private shareholdings. It can also raise funds from capital market.

MERITS

1. It can be easily formed as per the provision of companies Act. Only an executive decision of govt. is required.

2. It enjoys autonomy in management decisions and flexibility in day to day working.

3. These are able to control the market and curb unhealthy business practices.

LIMITATIONS

1. It suffers from interference from govt. officials, ministers and politicians.

2. It evades constitutional responsibility which a company financed by the govt. should have as it is not directly answerable to parliament.

3. The board usually consists of the politicians and civil servants who are interested more in pleasing their political bosses than in efficient operation of the company.

SUITABILITY:

(i) Where the private sector is also needed along with in govt.

(ii) Where activities related to finance are to be encouraged.

CHANGING ROLE OF PUBLIC SECTOR

Public sector in India was created to achieve two types of objective - (1) to speed up the economic growth of the country and (2) to achieve a more equitable distribution of income and wealth among people. The role and importance of public sector changed with time. Its role over a period of time can be summarized as following:

1. Development of Infrastructure: At the time of independence, India suffered from acute shortage of heavy industries such as engineering, iron and steel, oil refineries, heavy machinery etc. Because of huge investment requirement and long gestation period, private sector was not willing to enter these areas. The duty of development of basic infrastructure was assigned to public sector which it discharged quite efficiently.

2. Regional balance: Earlier, most of the development was limited to few areas like port towns. For providing employment to the people and for accelerating the economic development of backward areas many industries were set up by public sector in those areas.

3. Economies of scale: In certain industries (like Electric power plants. natural gas, petroleum etc) huge capital and large base are required to function economically. Such areas were taken up by public sector.

4. Control of Monopoly and Restrictive trade Practices – These enterprises were also established to provide competition to pvt. Sector and to check their monopolies and restrictive trade practices.

5. Import Substitution - Public enterprises were also engaged in production of capital equipments which were earlier imported from other countries. At the same time public sector Companies like STC and MMTC have played an important role in expending exports of the country. Very important role was assigned to public sector but is performance was far from satisfactory which forced govt. to do rethinking on public enterprises.

PUBLIC SECTORY REFORMS

In the industrial policy 1991, the govt. of India introduced four major reforms in public sector.

(I) Reduction in No. of industries reserved for public sector: This no. is reduced from 17 to 8 and to 3 only in 2001. These three industries are atomic energy arms and rail transport.

(II) Memorandum of Understanding (MOU): Under this govt. lays down performance target for public sector and gives greater autonomy to hold the management but held accountable for the specified results.

(III) Disinvestment: Equity shares of public sector enterprises were sold to private sector and the public. It was expected that this would lead to improved managerial performance and better financial discipline.

(IV) Restructural and Revival: All public sector sick units were referred to Board of Industrial and Financial Re-construction (BIFR). Unite which were potentially viable were restructured and which could not be reviewed were closed down by the board.

MULTINATIONAL COMPANIES/GLOBAL ENTERPRISES

Multinational company may be defined of a company that has business operations in several countries by having its factories, branches or offices in those countries. But is has its headquarter in one country in which it is incorporated.

Examples: PHILIPS, Coca Cola etc.

FEATURES

1. Huge Capital Resources: MNCs possess huge capital resources and they are able to raise lot of funds from various sources.

2. International Operations: A MNC has production, marketing and other facilities in several countries.

3. Centralized control: MNCs have headquarters in their home countries from where they exercise control over all branches and subsidiaries. It provides only broad policy framework to them and there is no interference in their day to day operations.

4. Foreign Collaboration: Usually they enter into agreements relating to sale of technology, production of goods, use of brand name etc. with local firms in the host country.

5. Advanced technology - These organisation possesses advanced and superior technology which enable them to provide world class products & services.

6. Product Innovations: MNCs have highly sophisticated research and development departments. These are engaged in developing new products and superior design of existing products.

7. Marketing Strategies - MNCs use aggressive marketing strategies. Their brands are well known and spend huge amounts on advertising and sale promotion.

JOINT VENTURES

Meaning: When two or more independent firms together establish a new enterprise by pooling their capital, technology and expertise, it is known as a joint venture.

Example: Hero Cycle of India and Honda Motors Co. of Japan jointly established Hero Honda. Similarily, Suzuki Motors of Japan and Maruti of Govt. of India come together to form Maruti Udyog.

FEATURES

1. Capital is provided jointly by the Government and Private Sector Entrepreneurs.

2. Management may be entrusted to the private entrepreneurs.

3. It combines both social and profit objectives.

4. It is responsible to the Government and the private investors.

BENEFITS

1. Greater resources and Capacity - In a joint venture the resources and capacity of two or more firms are combined which enables it to grow quickly and efficiently

2. Access to advanced technology - It provides access to advanced techniques of production which increases efficiency and then helps in reduction in cost and improvement in quality of product.

3. Access to New Markets and distribution network - A foreign co. gain access to the vast Indian market by entering into a joint venture with Indian Co. It can also take advantage of the well established distribution system of local firms.

4. Innovation - Foreign partners in joint ventures have the ideas and technology to develop innovative products and services. They have an advantage in highly competitive and demanding markets.

5. Low Cost of production - Raw material and labour are comparatively cheap in developing countries so if one partner is from developing country they can be benefitted by the low cost of production.

6. Well known Brand Names: When one party has well established brands & goodwill, the other party gets its benefits. Products of such brand names can be easily launched in the market.

Public Private Partnership (PPP):

It means an enterprise in which a project or service is finance and operated through a partnership of Government and private enterprises.

FEATURES:

1. Facilitates partnership between public sector and private sector.

2. Pertaining high priority project.

3. Suitable for big project (capital intensive and heavy industries).

4. Public welfare example Delhi Metro Railway Corporation.

5. Sharing revenue - Revenue is shared between government and private enterprises in the agreed Ratio.

-End-

CHAPTER 4 BUSINESS SERVICES

It has already been stated that commerce consists of trade and auxiliaries to trade. Auxiliaries or aids to trade refer to the activities related to the buying and selling of goods and services. These auxiliaries to trade are also known as business services or facilities. These services are essential and indispensable for the smooth flow of trade and industry. The examples of business services are Banking, insurance, transport, Warehousing ,Advertisement and communication.

NATURE OF BUSINESS SERV1CES:

1. Intangibility: Cannot be seen, touched or smelled. Just can only be felt, yet their benefits can be availed of e.g. Treatment by doctor.

2. Inconsistency: Different customers have different demands & expectation.e.g. Mobile services/Beauty Parlour.

3. In Separability: Production and consumption are performed simultaneously .For e.g. ATM may replace clerk but presence of customer is must.

4. Inventory Loss: Services cannot be stored for future use or performed earlier to be consumed at a later date. e.g. underutilized capacity of hotels and airlines during slack demand cannot be stored for future when there will be a peak demand.

5. Involvement: Participation of the customer in the service delivery is a must e.g. A customer can get the service modified according to specific requirement.

Type of Services:

1. Social Services: Provided voluntarily to achieve certain goals e.g. healthcare and education services provided by NGOs.

2. Personal Services: Services which are experienced differently by different customers. e.g. tourism, restaurants etc.

3. Business Services: Services used by business enterprises to conduct their activities smoothly. e.g. Banking, Insurance, communication, Warehousing and transportation.

Banks

Banks occupy an important position in the modern business World. No country can make commercial and industrial progress without a well organized banking system. Banks encourage the habit of saving among the public. They mobilize small savings and channelize them into productive uses.

Meaning of Bank

A bank is an institution which deals in money and credit. It collects deposits from the public and supplies credit, thereby facilitating exchange. It also performs many other functions like credit creation, agency functions, general services etc Hence ,a Bank is an organization which accepts deposits, lends money and perform other agency functions.

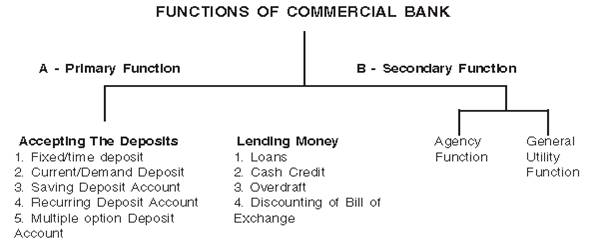

Primary Functions

1. Accepting Deposits: Accepting deposits is the main function of commercial banks. Banks offer different types of Bank accounts to suit the requirements and needs of different customers. Different types of Bank accounts areas follows:

A. Fixed Deposit Account: Money is deposited in the account for a fixed period is called as Fixed Deposit account. After expiry of specified period ,person can claim his money from the bank. Usually the rate of interest is maximum in this account. The longer the period of deposit, the higher will be the rate of interest on deposit.

B. Current Deposit Account: Current deposit Accounts are opened by businessman. The account holder can deposit and Withdraw money. Whenever desired. As the deposit is repayable on demand, it is also known as demand deposit. Withdrawals are always made by cheque. No interest is paid on current accounts. Rather charges are taken by bank for services rendered by it.

C.Saving Deposit Account: The aim of a saving account is to mobilize savings of the public. A person can open this account by depositing a small sum of money. He can withdraw money from his account and make additional deposits at will. Account holder also gets interest on his deposit. In this account though the rate of interest is lower than the rate of interest on fixed deposit account.

D.Recurring Deposit Account: The aim of recurring deposit is to encourage regular savings by the people. A depositor can deposit a fixed amount, say Rs. 100 every month for a fixed period. The amount together with interest is repaid on maturity. The interest rate on this account is higher than that on saving deposits.

E. Multiple Option Deposit Account: It is a type of saving Bank A/c in which deposit in excess of a particular limit get automatically transferred into fixed Deposit. On the other hand, in case adequate fund is not available in our saving Bank Account so, as to honour a cheque that we have issued the required amount gets automatically transferred from fixed deposit to the saving bank account. Therefore, the account holder has twin benefits from this amount (i) he can earn more interest and (ii) It lowers the risk of dishonoring a cheque.

2. Lending Money with the help of money collected through various types of deposits, commercial banks lend finance to businessman, farmers, and others. The main ways of lending money are as follows:

A. Term Loans: These loans are provided by the banks to their customers for a fixed period to purchases Machinery. Truck. Scooter. House etc. The borrowers repay the loans in Monthly/Quarterly/Half Yearly/Annual installments.

B. Bank Overdraft: The customer who maintains a current account with the bank, takes permission from the bank to withdraw more money than deposited in his account. The extra amount withdrawn is called overdraft. This facility is available to trustworthy customers for a small period. This facility is usually given against the security of some assets or on the personal security of the customer. Interest is charged on the actual amount overdrawn by the customer.

C. Cash Credit: Under this arrangement, the bank advances cash loan up to a specified limit against current assets and other securities. The bank opens an account in the name of the borrower and allows him to withdraw the borrowed money from time to time subject to the sanctioned limit. Interest is charged on the amount actually withdraw.

D. Discounting of Bill of Exchange: Under this, a bank gives money to its customers on the security of a bill of exchange before the expiry of the bill in ease of customers needs it. For this service bank charges discount for the remaining period of the bill.

Secondary Functions

The secondary functions of commercial banks are as under:

(1) Agent Functions

As an agent of its customers a commercial bank provides the following services:

(I) Collecting bills of exchange, promissory notes and cheques.

(II) Collecting dividends, interest etc.

(III) Buying and selling shares, debentures and other securities.

(IV) Payment of interest, insurance premium etc.

(V) Transferring funds from one branch to another and from one place to another.

(VI) Acting as an agent of representative while dealing with other banks and financial institutions. A Commercial banks performs the above functions on behalf of and as per the instructions of its customers.

(2) General Utility Functions:

Commercial banks also perform the following miscellaneous functions:

(I) Providing lockers for safe custody of jewellery and other valuables of customers.

(II) Giving references about the financial position of customers.

(III) Providing information to a customer about the credit worthiness of other customers.

(IV) Supplying various types of trade information useful to customer.

(V) Issuing letter of credit, pay orders, bank draft, credit cards and travelers cheques to customers.

(VI) Underwriting issues of shares and debentures.

(VII) Providing foreign exchange to importers and travellers going abroad.

Bank Draft: It is a financial instrument with the help of which money can be remitted from one place to another. Anyone can obtain a bank draft after depositing the amount in the bank. The bank issues a draft for the amount in its own branch at other places or other banks (only in case of tie up with those banks) on those places. The payee can present the draft on the drawee bank at his place and collect the money. Bank charges some commission for issuing a bank draft.

Banker's cheque or Pay Order: It is almost like a bank draft. It refers to that bank draft which is payable within the town. In other words banks issue pay order for local purpose and issue bank draft for outstation transactions.

ELECTRONIC BANKING SERVICES/E-BANKING

Use of computers and internet in the functioning of the banks is called electronic banking. Because of these services the customers don't need to go to the bank every time for every transaction. He can make transactions with the bank at any time and from any place. The chief electronic services are the following:

1. Electronic. Fund Transfer: Under it, a bank transfers wages and salaries directly from the company s account to the accounts of employees of the company. The other examples of EFTs are online payment of electricity bill, water bill, insurance premium, house tax etc.

2. Automatic Teller Machines: (ATMs) ATM is an automatic machine with the help of which money can be withdrawn or deposited by inserting the card and entering personal Identity Number (PIN). This machine operates for all the 24 hours.

3. Debit Card: A Debit Card is issued to customers in lieu of his money deposited in the bank. The customers can make immediate payment of goods purchased or services obtained on the basis of his debit card provided the terminal facility is available with the seller.

4. Credit Card: A. bank issues a credit card to those of its customers who enjoy good reputation. This is a sort of overdraft facility. With the help of this card ,the holder can buy goods or obtain services up to a certain amount even without having sufficient deposit in their bank accounts.

5. Tele Banking: Under this facility, a customer can get information about the account balance or any other information about the latest transactions on the telephone.

6. Core Banking Solution Centralized Banking Solution: In this system customer by opening a bank account in one branch (which has CBS facility) can operate the same account in all CBS branches of the same bank anywhere across the country. It is immaterial with which branch of the bank the customer deals with when he/she is a CBS branch customer.

7. National Electronic Fund Transfer: NEFT refers to a nationwide system that facilitate individuals, firms and companies to electronically transfer funds from any branch to any individual, firm or company having an account with any other bank branch in the country. NEFT settles transactions in batches. The settlement takes place at a particular point of time for example, NEFT settlement takes place 6 times a day during the week days (9.30am, 10.30 am, 12.00 noon, 1.00 pm. 3.00 pm & 4.00pm) and 3 times during Saturday 9.30 am, 10.30 am and 12.00 noon) Any transaction initiated after a designated settlement time is settled on the next fixed settlement time.

8. Real Time Gross Settlement: RTGS refers to a funds transfer system where transfer of funds takes place from one bank to another on a Real-time and on Gross basis. Settlement in Real time means transactions are settled as soon as they are processed and are not subject to any waiting period. Gross settlement means the transaction is settled on one to one basis without bunching or netting with any other transaction. This is the fastest possible money transfer system through the banking channel. The RTGS service for customers is available from 9.00 am to 3.00 pm on weekdays and from 9.00 am to 12.00 noon on Saturdays. The basic difference between RTGS and NEFT is that while RTGS transactions are processed continuously, NEFT settles transactions in batches.

Benefits of E-Banking to customer:

1. E-Banking provides 24 hours a day X 365 days a year services to the customers.

2. Customers can make transactions from office or house or while traveling via mobile telephone.

3. There is greater customer satisfactions through E-banking as it offers unlimited access and great security as they can avoid travelling with cash.

Benefits of E-Banking to Banks:

1. E-Banking lowers the transaction cost.

2. Load on branches can be reduced by establishing centralized data base.

3. E-Banking provides competitive advantage to the bank, adds value to the banking relationship.

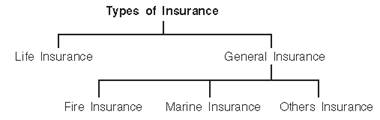

Meaning of insurance:

Insurance is a contract under which one party (Insureror Insurance Company) agrees in return of a consideration (Insurance premium) to pay an agreed sum of money to another party (Insured) to make good for a loss, damage or injury to something of value in which the insured has financial interest as a result of some uncertain event.

Principles of Insurance: These principles are :

1. Utmost Good Faith: Insurance contracts are based upon mutual trust and confidence between the insurer and the insured. It is a condition of every insurance contract that both the parties i.e.insurer and the insured must disclose every material fact and information related to insurance contract to each other.

2. Insurable Interest: It means some pecuniary interest in the subject matter of insurance contract. The insured must have insurable interest in the subject matter of insurance i.e., life or property insured the insured will have to incur loss due to this damage and insured will be benefitted if full security is being provided. A businessman has insurable interest in his house, stock, his own life and that of his wife, children etc.

3. Indemnity: Principle of indemnity applies to all contracts except the contract of life insurance because estimation regarding loss of life cannot be made. The objective of contract of insurance is to compensate to the insured for the actual loss he has incurred. These contracts ‘provide security from loss and no profit can be made out of these contracts.

4. Proximate Cause: The insurance company will compensate for the loss incurred by the insured due to reasons mentioned in insurance policy. But if losses are incurred due to reasons not mentioned in insurance policy than principle of proximate cause or the nearest cause is followed.

5. Subrogation: This principle applies to all insurance contracts which are contracts of indemnity. As per this principle, when any insurance company compensates the insured for loss of any of his property, then all rights related to that property automatically gets transferred to insurance company.

6. Contribution: According to this principle if a person has taken more than one insurance policy for the same risk then all the insurers will contribute the amount of loss in proportion to the amount assured by each of them and compensate for the actual amount of loss because he has no right to recover more than the full amount of his actual loss.

7. Mitigation: According to this principle the insured must take reasonable steps to minimize the loss or damage to the insured property otherwise the claim from the insurance company may be lost.

Concept of Life Insurance:

Under life insurance the amount of Insurance is paid on the maturity of policy or the death of policy holder whichever is earlier. If the policy holder survives till maturity he enjoys the amount of insurance. If he dies before maturity then the insurance claim helps in maintenance of his family. The insurance company insures the life of a person in exchange for a premium which may be paid in one lump sum or periodically say yearly, half yearly quarterly or monthly.

Types of Life Insurance Policies:

1. Whole Life Policy: Under this policy the sum insured is not payable earlier than death of the insured. The sum becomes payable to the heir of the deceased.

2. Endowment Life Insurance Policy: Under this policy the insures undertakes to pay the assured to his heirs or nominees a specified summon the attainment of a particular age or on his death whichever is earlier.

3. Joint Life Policy: It involves the insurance of two or more lives simultaneously. The policy money is payable on the death of any one olives assured and the assured sum will be payable to the survivor or survivors.

4. Annuity Policy: This policy is one under which amount is payable in monthly, quarterly, half yearly or annual installments after the assured attains a certain age. This is useful to those who prefer a regular income after a certain age.

5. Children’s Endowment Policy: This policy is taken for the purpose of education of children or to meet marriage expenses. The insurer agrees to pay a assured sum when the child attains a certain age.

Fire Insurance: It provides safety against loss from fire. If property of insured gets damaged due to property as compensation from insurance company. If no such event happens,then no claim shall be given.

Features:

1. Utmost Good Faith

2. Contract of Indemnity

3. Insurable Interest in Subject matter.

4. Subject to the doctrine of causa proxima.

5. It is a contract for an year. It generally comes to an end at the expiry of the year and may be renewed.

Marine Insurance: Marine Insurance provides protection against loss during sea voyage. The businessmen can get his ship insured by paying the premium fixed by the insurance company. The functional principles of marine insurance are the same as the general principles of Insurance.

OTHER INSURANCE

Health Insurance: With a lot of awareness today,Health insurance has gained a lot of popularity. General Insurance companies provide special health insurance policies such as Mediclaim for the general public. The insurance company charges a nominal premium every year and in return undertakes to provide up to stipulated amount for the treatment of certain diseases such as heart problem, cancer, etc.

Communication: In this fast moving and competitive world it is essential to have advanced technology for quick exchange of information with the help of electronic media. It is an important service that helps in establishing links between businessmen. Organization, suppliers, customers etc. It educates people, widen their knowledge and broaden their outlook. It overcomes the problem of distance between people, businessmen and institutions and thus,it helps in smooth running of business activities. The main services can be classified into postal and telecom.

Postal Services: This service is required by every business to send and receive letters, market reports, parcel, money order etc.on regular. All these services are provided by the post and telegraph offices scattered throughout the country. The postal department performs the following services.

1. Financial Services :They provide postal banking facilities to the general public and mobilize their savings through the following saving schemes like public provident fund (PPF), KisanVikasPatra, National Saving Certificate, Recurring Deposit Scheme and Money Order facility.

2. Mail Services :The mail services offered by post offices includes transmission of messages through post cards, Inland letters, envelops etc. The various mail services all:

1. UPC (under postal certificate): When ordinary letters are posted the post office does not issue any receipt. However, if sender wants to have proof then a certificate can be obtained from the post office on payment of prescribed fee. This paper now serves as a evidence of posting the letters.